Perturbation Methods in Credit Derivatives

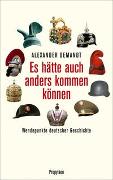

BücherAngebote / Angebote:

Perturbation Methods in Credit Derivatives: Strategies for Efficient Risk Management details a new approach based on perturbation analysis to pricing credit-contingent financial instruments. Simple analytic formulae are deduced for prices of single-name credit derivatives such as credit default swaps and swaptions and hybrid products involving equities, inflation indices and/or FX and interest rates. As a byproduct, accurate analytic formulae are derived for vanilla interest rate options without simplifying assumptions such as constant coefficients, short times to maturity and/or fast/slow volatility evolution. The method is also applicable to CVA/DVA calculations and contingent CDS pricing. It is shown how the techniques proposed facilitate the efficient calculation of model risk and market risk, in particular reducing the computational burden associated with the stress testing increasingly required for regulatory purposes.

Lieferbar in ca. 10-20 Arbeitstagen